Loss Aversion explained in exactly 500 words

You're not built to chase your dreams.

Ever blamed yourself for playing it too safe in life?

I’ve got good news - it’s not your fault.

Through the phenomenon of natural selection, you have evolved to be a safety-seeking creature that aims to survive and reproduce, not thrive and reproduce.

Your ancestors only needed to stay alive long enough to find a mate and have kids. It didn’t matter if they fulfilled their dreams in the process (unless their dream was to find a mate and have kids – in which case, they killed two birds with one bone).

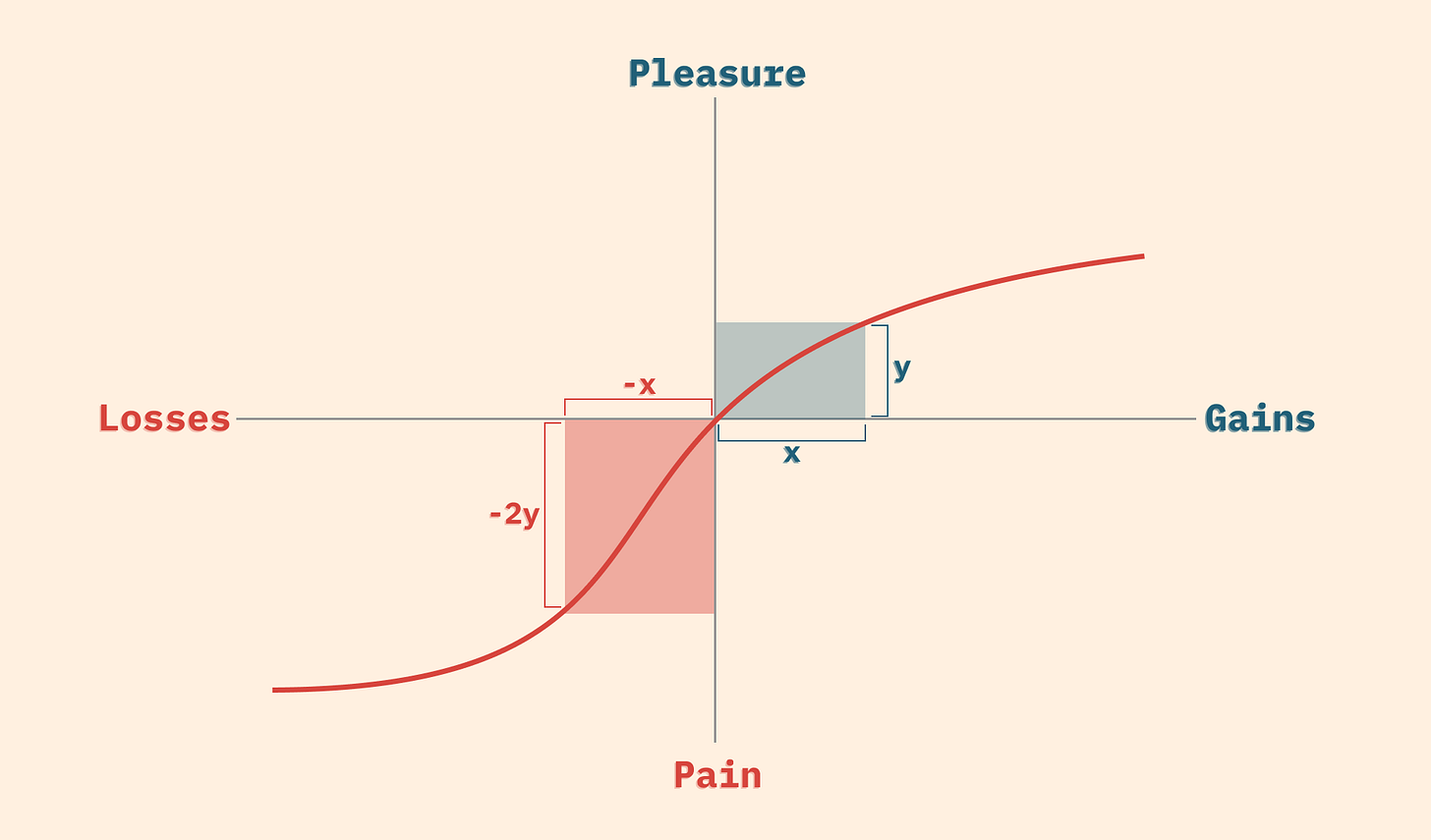

This evolutionary advantage of safety over adventure manifests itself in a tendency we fondly call loss aversion, in which the pain from a loss feels more significant than the pleasure from an identical gain.

Confused? Let me explain.

Imagine we’re playing a game in which I toss a coin.

Heads: You pay me $100

Tails: I pay you $100Would you take the bet? No?

How about this one:

Heads: You pay me $100

Tails: I pay you $120Still no?

While it might seem perfectly rational to take the second bet, most people won’t do it.

In fact, most people won’t take a bet like this until the potential losses are only half of the potential gains, even though the probabilities of both are identical.

That’s because we’ve evolved to overvalue losses compared to gains.

If you think about this from an evolutionary standpoint, overvaluing losses makes sense.

In the game of evolution, winning implies surviving another day, not forever. However, losing implies death. And death implies that it’s game over for you and your genes.

Humans that were loss averse ended up being more likely to survive and pass on their genes to future generations, of which you, dear reader, are a part.

Another consequence of loss aversion is that humans are risk-averse while winning but risk-loving while losing.

I’ll explain with the help of another imaginary game.

Q1: Choose one

A] A 90% chance to win $1000

B] Win $900 guaranteed

Q2: Choose one

A] A 90% chance to lose $1000

B] Lose $900 guaranteedLet me guess - you picked option B for Q1, and option A for Q2, didn’t you?

This is loss aversion at play. We’re so averse to losing that we become more open to risks when faced with losses, and we prefer to play it safe when faced with gains.

Again, evolutionarily, this makes perfect sense. If you’re facing a loss (death), you take whatever risks you have to take to avoid it.

On the other hand, locking in a guaranteed gain that will help you survive is a better strategy than gambling for a larger gain that will help you thrive.

Now that you know what loss aversion is, should you seek to fight it or embrace it?

Well, it depends on the type of game you’re playing. If the consequences of losing imply that it’s game over, embrace loss aversion.

If not, fight it.

Then, learn from your losses, and try again.

For those of you wondering why I didn’t publish an issue of Complexity Condensed last week – I’ve had a stressful couple of weeks with Covid-19 making its way through my family.

Since I recovered from it a couple of months ago, looking after them was my priority, and writing took a backseat.

I am currently writing this issue from the Covid ward of a hospital where I’ve spent the past 5 days with my father while he undergoes treatment.

Hopefully, things get back to normal soon.

Please send good vibes.

If you’re new here, and you like what you see, I’d be grateful if you subscribed.

Also, if you liked this issue enough to share it, please don’t hesitate to do so!

This is so cool! I read something recently about dangerous Vs scary - where things which we're scared of aren't really dangerous and the stuff we're not scared of are statistically more dangerous. Not sure how that ties into this but I thought of that while reading :)

Love this idea and the design. Your success if guaranteed, my friend! A good entry here as my first read. I'm a huge fan of graphics too!

A couple notes: as I read your "About" I was wondering, "Who is this guy who thinks he knows enough about everything?" (read that in a gentle tone, please!) I was curious to hear if you're a journalist, a doctor, a teacher - or even just relentlessly curious. I would have accepted any description, but it left me wondering where you're coming from.

Also: "exactly 500" words seems a bit limiting. Made me think if you fell short you might add filler. Or you might skip topic that required extreme condensing. This could be a case of me taking marketing copy too seriously, tho but I felt "in around 500 words" felt better.

Regardless, love your newsletter, going to dive into the next ones ASAP. Hope you dont mind the feedback! Sending good vibes!